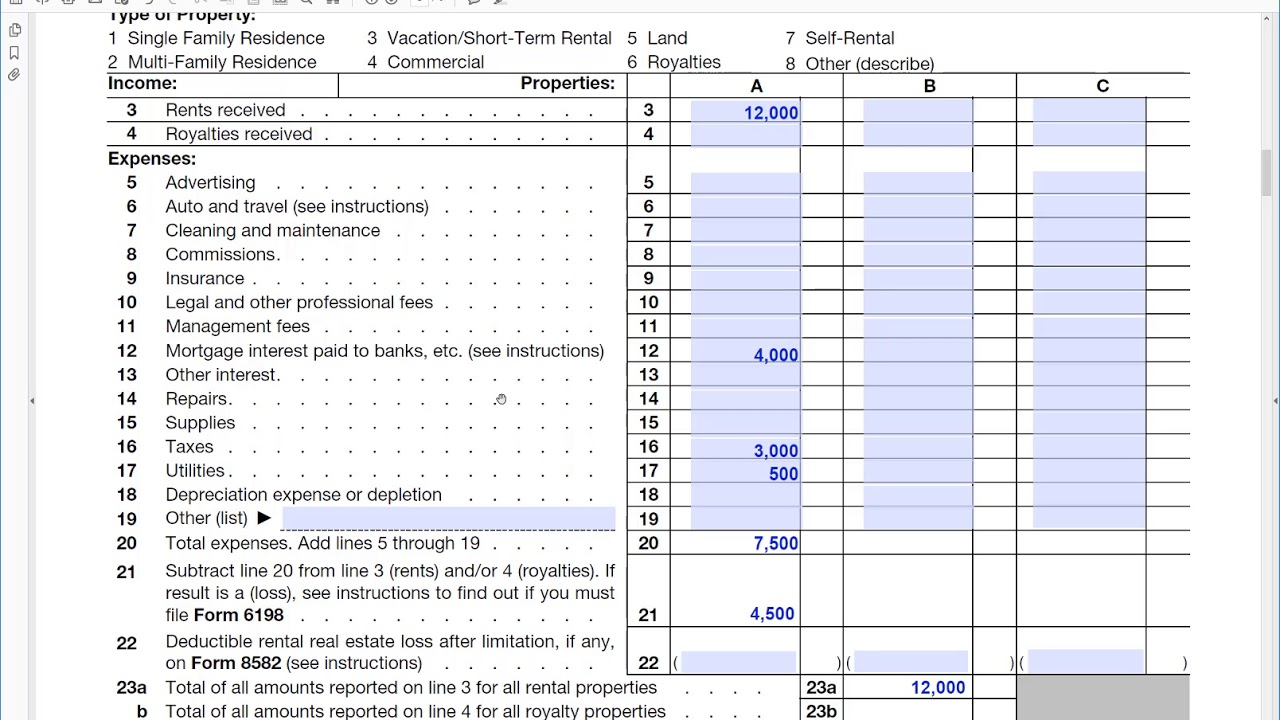

Subtract A3 Add back insurance expense. Mortgage Interest Line 12 5 6.

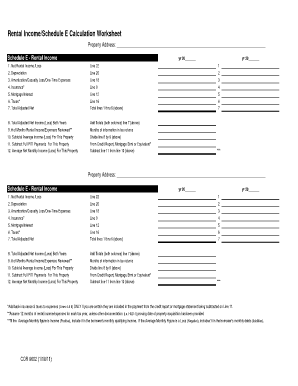

1040 Schedule E Tax Court Method Election

Use the same format as on Schedule E.

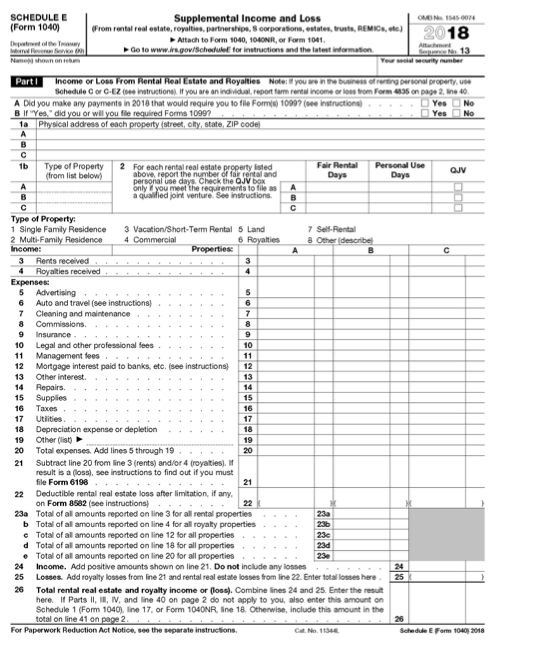

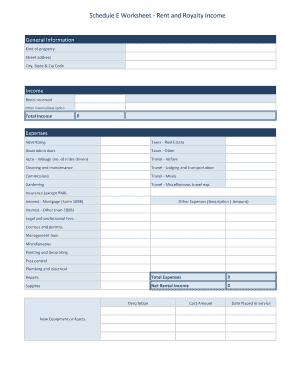

Schedule e rental income worksheet. You can attach your own schedules to report income or loss from any of these sources. Maximum 12 Income Loss. Schedule E Line 21 Depreciation.

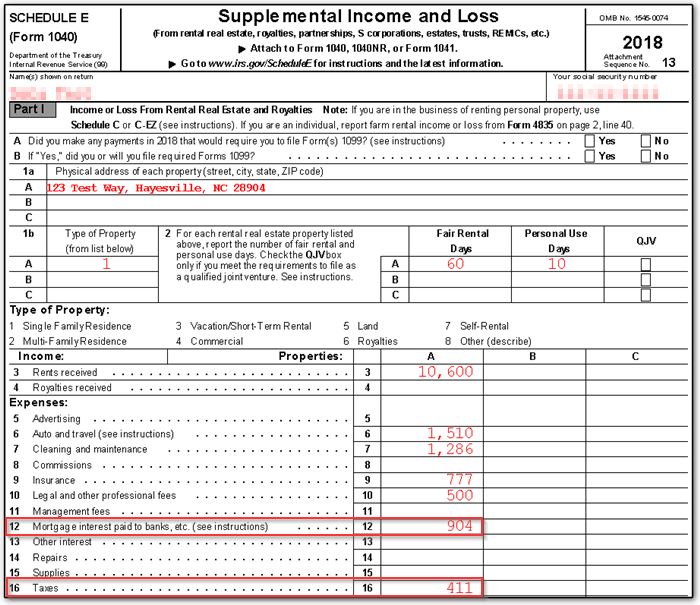

AmortizationCasualty LossOne-Time Expenses Line 18 3 4. Schedule E Form 1040 If you rent buildings rooms or apartments and provide basic services such as heat and light trash collection etc you normally report your rental income and expenses on Schedule E Part I. Schedule E - Part I A1 Enter total rents received.

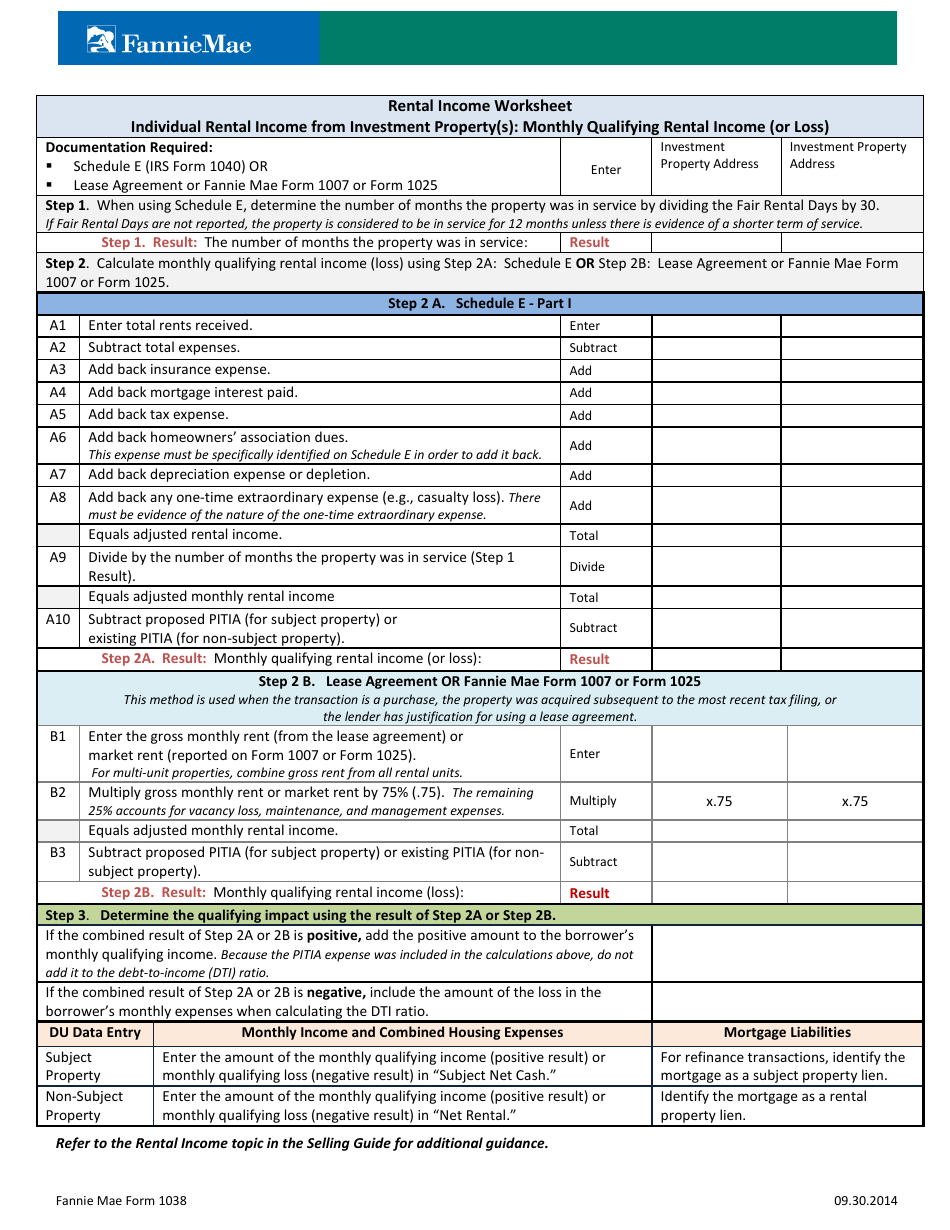

Depreciation Line 20 2 3. This form is a tool to help the Seller calculate the net rental income from Schedule E. Schedule e irs form 1040 or lease agreement or fannie mae form 1007 or form 1025 enter investment property address step 1.

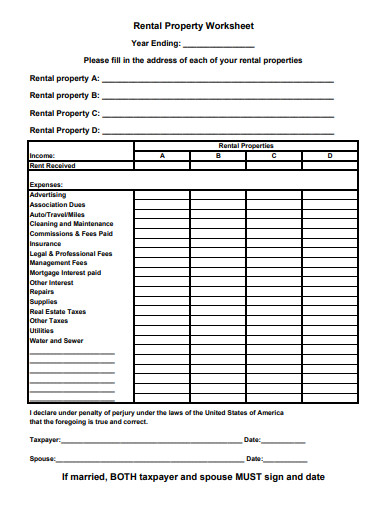

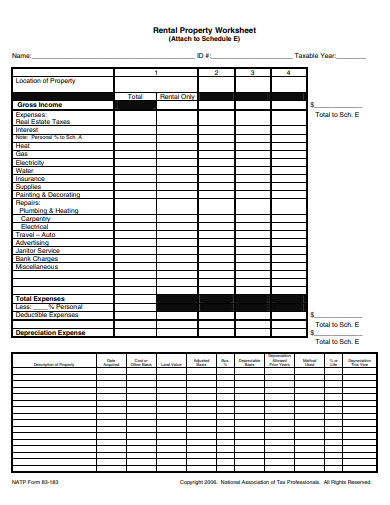

Schedule E - Rental Real Estate Form 1040 Schedule E is used to report income or loss from rental real estate royalties partnerships S corporations estates and trusts. The Rental Property Worksheet works on the income and the expenses regarding your property so that all the rent incurred from the rentals and also the expenditure can be added properly for the tax valuation. The Sellers calculations must be based on the requirements and guidance for the determination of stable monthly income in Guide Chapter 5306.

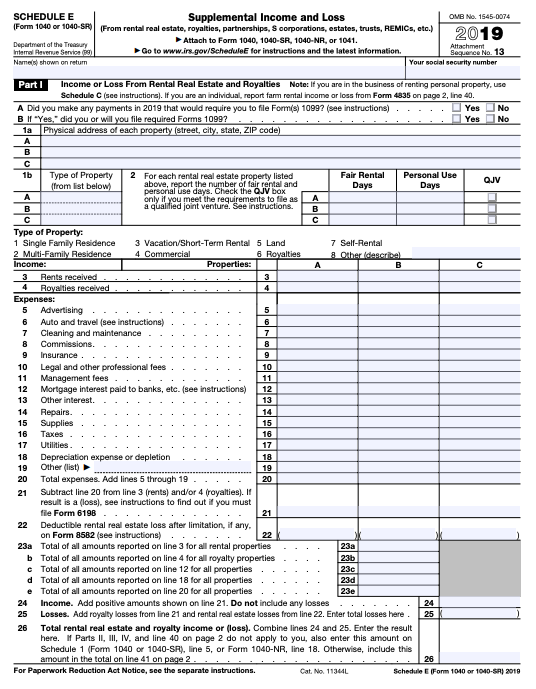

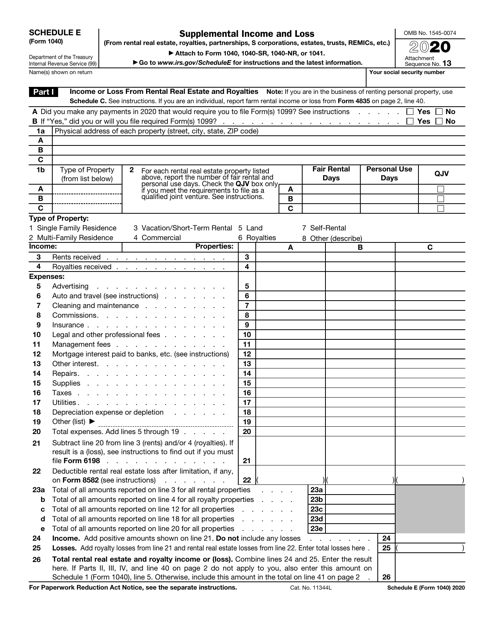

Schedule E - Rental Income 1. Use Schedule E Form 1040 to report income or loss from rental real estate royalties partnerships S corporations estates trusts and residual interests in REMICs. When using Schedule E determine the number of.

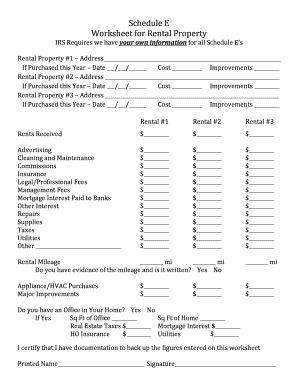

Please use the following calculator and quick reference guide to assist in calculating rental income from IRS Form 1040 Schedule E. 10 days ago Rental Income Worksheet Based on the usage of the propertyies complete your rental analysis using Schedule E Lease Agreement or alternate or Form 8825 as required by your investor. Lease Agreement or alternate Insurance.

Schedule E Line 18. Rental Income Worksheet Individual Rental Income from Investment Propertys. SCHEDULE E Form 1040 Department of the Treasury Internal Revenue Service 99 Supplemental Income and Loss From rental real estate royalties partnerships S corporations estates trusts REMICs etc Attach to Form 1040 1040-SR 1040-NR or 1041.

The tax will be deducted from the income from the rent and there are the deductions such as the utilities and the other expenses. List your total income expenses and depreciation for each rental property. NET Monthly Rental Income Loss NA.

Total Adjusted Net Total lines 1 thru 6 above 7 8. Download fha rental income calculation worksheet pngrental income can be used to qualify for an fha loan and fha loans can also be used to purchase rental properties if the subject property will also be the fact. Schedule E Line 19.

Add A4 Add back mortgage interest paid. It provides suggested guidance only and does not replace Fannie Mae or Freddie Mac instructions or applicable guidelines. Schedule E OR Step 2B.

When using Schedule E determine the number of months the property was in service by dividing the Fair Rental Days by 30. Enter A2 Subtract total expenses. Net Rental Income Loss Line 22 1 2.

Lease Agreement or Fannie Mae Form 1007 or Form 1025. Taxes Line 16 6 7. Insurance Line 9 4 5.

Rental Rental Detail View All Rental Categories. You can attach your own schedule s to report income or loss from any of these sources. Monthly Qualifying Rental Income or Loss Documentation Required.

Calculate monthly qualifying rental income loss using Step 2A. How to fill out Schedule E Rental Property is a video discussing the schedule required for reporting your rental income on your individual income tax return. Schedule E Line 9 AmortizationCasualty LossHOA Dues if applicable.

Go to wwwirsgovScheduleE for instructions and the latest information. Average NET Monthly Rental Income Loss ____ months. This form is commonly used to report income or loss from rental real activities both residential real estate and commercial real estate.

Rental Income Schedule E Calculation Worksheet cash flow analysis form 1084 fannie mae lancaster county earned income tax return instructions travel policies and procedures department of procurement schedule e allocation of rental and personal expenses 10 total monthly child support obligation of each 7 australian annuities and superannuation income. If Fair Rental Days are not reported the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Schedule E IRS Form 1040 OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1.

This form does not replace the requirements and guidance for the. Form 92 is to be used to document the Sellers calculation of net rental income from Schedule E. Income and Loss Use Schedule E Form 1040 to report income or loss from rental real estate royalties partnerships S corporations estates trusts and residual interests in REMICs.

Total Adjusted Net Income Loss Both Years Add Totals both columns line 7 above.

Fannie Mae Rental Income Worksheet Fill Online Printable Fillable Blank Pdffiller

Schedule E Instructions For 2020 Taxhub

Irs Form 1040 Schedule E Download Fillable Pdf Or Fill Online Supplemental Income And Loss 2020 Templateroller

Fannie Mae Form 1038 Download Printable Pdf Or Fill Online Rental Income Worksheet Templateroller

Analyzing Schedule E Rental Income 2 1 18 Youtube

18 Rental Property Worksheet Templates In Pdf Free Premium Templates

Understanding The Schedule E For Rental Properties

What Is Schedule E Here S An Overview For Your Rental Property Taxes

Fillable Online Schedule E Worksheet For Rental Property Fax Email Print Pdffiller

Schedule E Tax Form Survive Guide For Rental Properties

E Schedule Worksheet Instructions

18 Rental Property Worksheet Templates In Pdf Free Premium Templates

Schedule E Worksheet Fill Online Printable Fillable Blank Pdffiller

Schedule E Screen Design Drake16 Schedulee

Schedule E Worksheet Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Irs Schedule E Rental Income Or Loss Youtube

Schedule E Worksheet Fill Online Printable Fillable Blank Pdffiller

Schedule E Worksheet Fill And Sign Printable Template Online Us Legal Forms

How To Fill Out Schedule E Rental Property On Your Tax Return Youtube

0 comments