Railroad Retirement Taxable Income Worksheet

August 31, 2021Minnesota does not tax benefits you receive from the Railroad Retirement Board RRB for unemployment sick pay or retirement. Form W-4V is available at any IRS office.

Retirement Income Pensionsannuities Social Securityrailroad Retirement Benefits Iras401

The Form RRB-1099 tax statement is issued by the US.

Railroad retirement taxable income worksheet. Armed Forces or Michigan National Guard and Completing Section D of Form 4884 to determine your allowable subtraction on Form 4884 Section D line 28. Social security or the SSEB portion of tier 1 are not taxable for 1996 because your income as fig-railroad retirement benefits paid to individuals who are ured in the following worksheet is not more than your. The RRB will not withhold state income taxes from railroad retirement payments.

Form RRB-1099-R reports the total gross payments repayments and the related US. You will need to determine if any of the railroad retirement payments made to you are taxable. Other income is taken into account in determining whether your benefits are taxable.

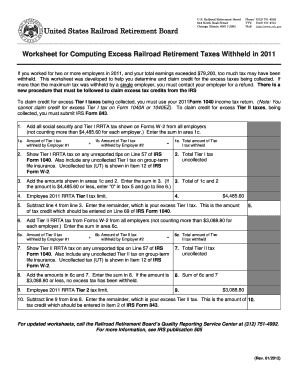

Railroad Retirement Board RRB and represents payments made to you in the tax year indicated on the statement. Worksheet 2 for Filers with Taxable Railroad Retirement Benefits or Qualifying Pension and Retirement Benefits from Service in the US. If you worked for two or more employers in 2019 and your total earnings exceeded 98700 too much tax may have been withheld.

Explanation of items on Form RRB-1099 are on the back of this explanation sheet. Planning Tip. This worksheet was developed to help you determine and claim credit for the excess taxes being collected.

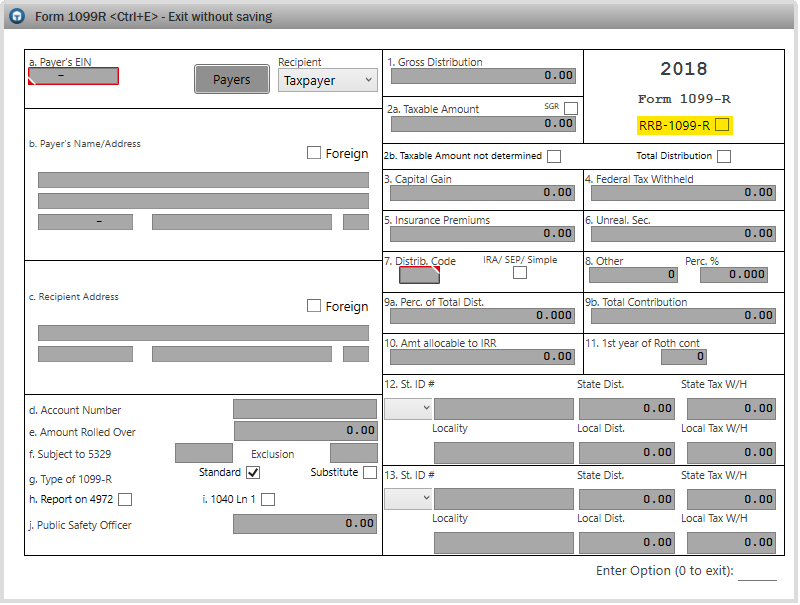

Federal income tax withheld from the Non- Social Security Equivalent Benefit NSSEB portion of tier I tier II vested dual benefit VDB and supplemental annuity payments. If the only income received during they ear was Social Security or Railroad Retirement benefitsthe benefits are generally not taxable. Under the treaty with In- not have any tax-exempt interest income.

Railroad retirement annuities are not taxable by states in accordance with section 14 of the Railroad Retirement Act 45 USC. 721 covers the tax treatment of federal retirement benefits primarily those paid under the Civil Service Retirement System CSRS or the Federal Employees Retirement System FERS. Tax from your benefits unless you file Form RRB-1001 Nonresident Questionnaire with the RRB to provide citizenship and residency information.

The Railroad Retirement Board RRB does the calculation of those two components and issues an IRS Form 1099 to you in January showing them. The RRB will not withhold taxes from the SSEB portion of your annuity unless you file IRS Form W-4V. Taxpayers should consider taking taxable IRA distributions andor doing Roth conversions.

The Social Security Equivalent portion is taxed the same way Social Security benefits are taxed. The calculation of taxable benefits starts with one-half of your gross Social Security or Railroad Retirement benefits from Box 5 of Form SSA-1099 or RRB-1099. Your benefits wont be taxable unless the sum of your modified adjusted gross income MAGI plus.

It also covers benefits paid from the Thrift Sav- ings Plan TSP. If any of these benefits were taxed on your federal return you may subtract them from your Minnesota taxable income. Worksheet for Computing Excess Railroad Retirement Taxes Withheld in 2019.

Social security and equivalent tier 1 railroad retire-. You qualify if your federal adjusted gross income includes Tier 1 or Tier 2 RRB benefits. TaxSlayer incorrectly includes RR.

The RRB will withhold US. It is prepared through the joint efforts of the IRS the Social Security Administration SSA and the US. Armed Forces or Michigan National Guard and Completing Section C of Form 4884.

File the completed form at any Railroad Retirement Board RRB office. Railroad Retirement Board RRB. If you dont file Form RRB-1001 the RRB will consider you a nonresident alien and withhold tax from your railroad retirement benefits at a 30 rate.

Complete Worksheet for Filers with Taxable Railroad Retirement Benefits or Qualifying Pension and Retirement Benefits from Service in the US. This publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retire-ment benefits. If the only income you received during the tax year was your social security or equivalent railroad retirement benefits your benefits may not be taxable and you may not have to file a tax return.

10 rows Railroad Retirement Worksheet. You can choose to have taxes withheld from the SSEB portion of your railroad retirement annuity by filing IRS Form W-4V. Your benefits dia US.

Social security benefits include monthly retirement sur-. All other railroad retirement benefits included in federal adjusted gross income that are either exempt from state taxation or deductible in computing. Form RRB W-4P is used by United States citizens or legal residents for US.

Tries are exempt from US. The portion of your railroad retirement benefits that are included on line 6b of your federal 1040 or 1040-SR should be deducted on the taxable social security benefits line of Ohio Schedule A. Purpose of Form RRB W- 4P.

Between 50 and 85 will be subject to Federal taxation depending on the amount of your other taxable income. The following video describes the tax statements issued by the Railroad Retirement Board each January for federal Income tax purposes.

This Video Worksheet Allows Students Learn About The Value Of Money And Social Studies Lesson Plans Economics Lessons Teachers Pay Teachers Freebies

Retirement Income Pensionsannuities Social Securityrailroad Retirement Benefits Iras401

Retirement Income Tax Considerations Reporting Study Com

Free Retirement Planning Excel Spreadsheet One Of The Most Important Forms Of Investment For Retirement Budget Home Budget Template Budget Spreadsheet

Retirement Income Pensionsannuities Social Securityrailroad Retirement Benefits Iras401

Florida Income Tax Calculator Smartasset Com Property Tax Income Tax Tax

Maintenance Vs Improvements Rental Property Tax Benefits Rental Property Property Tax Tax Deductions

Social Security And Railroad Retirement Equivalent Ppt Video Online Download

Retirement Income Pensionsannuities Social Securityrailroad Retirement Benefits Iras401

Tax Tip How Social Security And Railroad Retirement Is Taxed Thestreet

Mortgage Calculator Spreadsheet In 2021 Personal Financial Planning Financial Planning Financial Plan Template

Form Rrb 1099 R Railroad Retirement Benefits Support

Retirement Income Pensionsannuities Social Securityrailroad Retirement Benefits Iras401

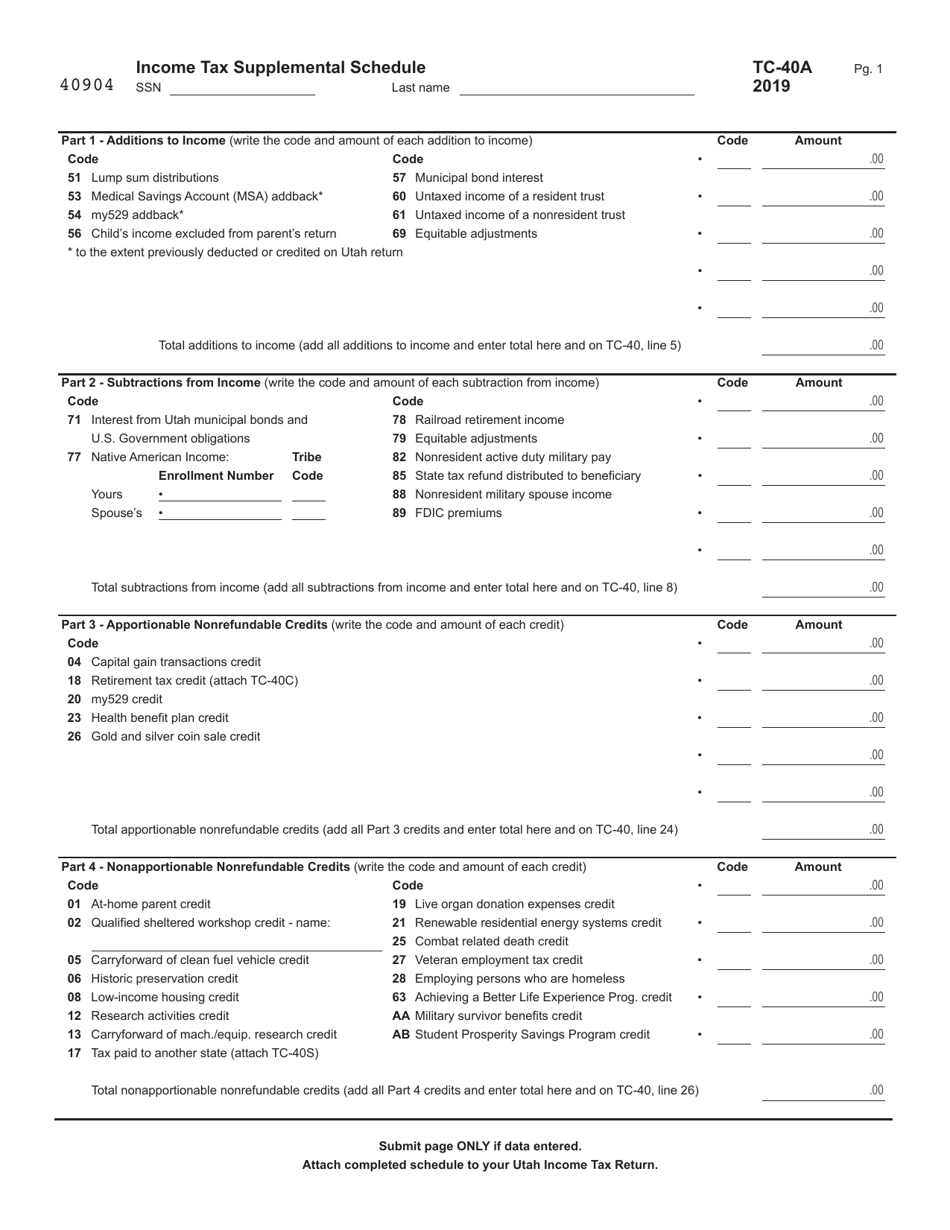

Form Tc 40a Schedule A Download Fillable Pdf Or Fill Online Income Tax Supplemental Schedule 2019 Utah Templateroller

How To Write A Check Cheque Writing 101 Writing Checks Life Skills Personal Finance

Fillable Online Rrb Railroad Retirement Taxable Income Worksheet Fax Email Print Pdffiller

0 comments